- The Business Bulletin Newsletter

- Posts

- What Financial Literacy Really Means (And Why School Never Taught It)

What Financial Literacy Really Means (And Why School Never Taught It)

The money skills that separate the wealthy from everyone else

Hey friend,

You spent years learning algebra, memorising historical dates, and dissecting frogs. But did anyone ever teach you how money actually works? How to build wealth? How to make your money work for you instead of constantly working for money?

Probably not. That’s the gap financial literacy fills.

Today I’m explaining what financial literacy really means, the revolutionary concepts from Robert Kiyosaki’s “Rich Dad Poor Dad,” and how you can start building these skills right now.

What Financial Literacy Actually Is

Financial literacy isn’t about becoming a math genius or memorizing investment formulas. It’s simpler than that.

Financial literacy means understanding how money works in the real world - how to earn it, manage it, invest it, and most importantly, how to make it grow.

It’s the difference between:

- Living paycheck to paycheck vs. having money work for you

- Trading time for money forever vs. building passive income

- Being controlled by money vs. controlling your money

Here’s the uncomfortable truth: most people graduate school with zero financial education. We can calculate the area of a triangle but can’t explain compound interest. We memorised the periodic table but don’t understand how taxes work.

That’s not an accident - it’s a massive gap in our education system.

The Two Dads Who Changed Everything

In 1997, Robert Kiyosaki published “Rich Dad Poor Dad” and it became one of the bestselling personal finance books ever. Why? Because it exposed truths about money that most people never learn.

The book contrasts two father figures in Robert’s life:

Poor Dad (his biological father): Highly educated with a PhD, worked for the government his whole life, believed in getting good grades, finding a secure job, and working hard. Despite his education and hard work, he struggled with money his entire life.

Rich Dad (his best friend’s father): Dropped out of school at 13, became one of Hawaii’s richest men. He understood how money works and taught Robert lessons that schools never would.

The book isn’t about education being worthless - it’s about how traditional education doesn’t teach financial intelligence.

The Core Lessons That Change Lives

Lesson 1: The Rich Don’t Work for Money

Poor Dad said: “Go to school, get good grades, find a secure job.”

Rich Dad said: “The poor and middle class work for money. The rich have money work for them.”

Most people trade their time for money their entire lives. They get paid, spend it, then need more money, so they work more. It’s an endless cycle.

Wealthy people break this cycle by buying assets that generate income without them actively working. Their money makes more money while they sleep.

Lesson 2: Understand Assets vs. Liabilities

This is Kiyosaki’s most famous concept, and it’s brilliantly simple:

- Assets: Things that put money IN your pocket

- Liabilities: Things that take money OUT of your pocket

Rich people buy assets. Poor people buy liabilities thinking they’re assets.

Example: Most people think their house is an asset. But if it’s not generating income and you’re paying a mortgage, property taxes, and maintenance - it’s taking money OUT of your pocket every month. That makes it a liability.

A rental property that generates more income than expenses? That’s an asset.

Lesson 3: Mind Your Own Business

Poor Dad said: “I work for the company.”

Rich Dad said: “Mind your own business - focus on building your asset column.”

This doesn’t mean quit your job. It means while working your job, spend your free time and money building income-generating assets: rental properties, stocks, businesses, intellectual property.

Your job pays your bills. Your assets build your wealth.

Lesson 4: The Rich Invent Money

Financial literacy means spotting opportunities others miss. Seeing ways to make money that the financially illiterate never notice.

When markets crash, the financially literate see buying opportunities. When others panic, they see chance.

Lesson 5: Work to Learn, Not to Earn

Rich Dad encouraged Robert to take jobs that taught valuable skills - sales, marketing, communication, leadership - not just jobs that paid the most.

Poor Dad focused only on job security and steady paychecks.

The financially literate understand that skills compound. Today’s learning becomes tomorrow’s earning.

The Cash Flow Quadrant

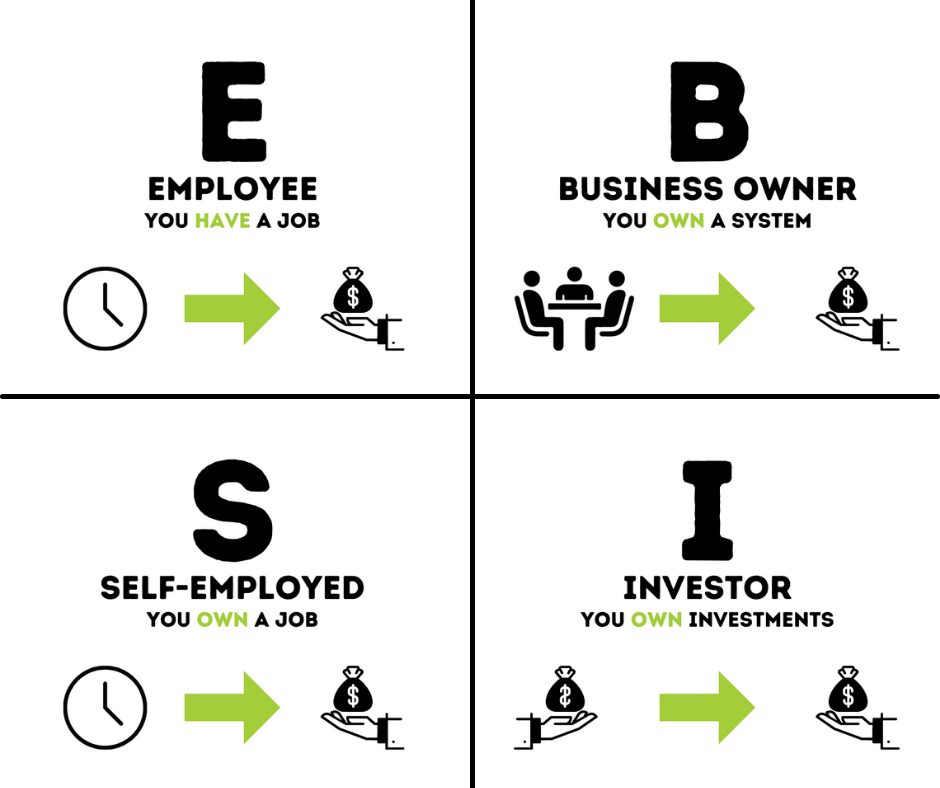

Kiyosaki created a simple model showing four ways people make money:

E (Employee): Trade time for money. Limited earning potential.

S (Self-Employed): You own your job. More control but still trading time for money.

B (Business Owner): You own a system that makes money without you. Scalable.

I (Investor): Your money works for you. Ultimate leverage.

Most people spend their lives in E or S quadrants. The wealthy move to B and I quadrants where money works for them.

How to Build Financial Literacy